“We’re anticipating a change in coverage for a lot of people now.”

That’s how Marcial Oquendo Rincon, MD, who operates a group of 18 clinics across the Dallas-Fort Worth Metroplex, characterized the gathering storm that he and other Texas physicians saw coming in the months leading up to a deadline at the end of last year.

In the face of expiring insurance subsidies that have helped cover millions of Texans, plus other federal changes impacting the Affordable Care Act (ACA) marketplace, physicians are bracing for an anticipated surge in the state’s uninsured rate and the churn that could affect their practices and patient care.

In 2010, the ACA created income-based premium tax credits (PTCs) to help make health insurance more affordable for Americans purchasing coverage on marketplace exchanges. Individuals could choose to have advanced disbursements of the PTC (also known as the Advance Premium Tax Credit or APTC) to be automatically applied to their monthly insurance premium.

These tax credits remained largely unchanged until the 2021 budget bill known as the American Rescue Plan Act enhanced the advanceable premium tax credits (also known as the enhanced Advance Premium Tax Credit, or eAPTC) by boosting the amount of financial assistance available to purchase ACA marketplace plans through removing what was then referred to as a “subsidy cliff,” namely the income limit of 400% of the federal poverty level (FPL).

The eAPTCs were extended under the 2022 Inflation Reduction Act budget bill but were set to expire at the end of 2025 except for Congressional action that had not arrived as of this writing.

The 2025 One Big Beautiful Bill Act (OBBBA) budget bill did not address the eAPTCs, which meant congressional action would be necessary to extend them before they expire, prompting a call from organized medicine for federal lawmakers to act.

“These enhanced credits have made health coverage more affordable for the more than 24 million Americans who purchased coverage through the health insurance marketplaces in 2025, including many who are older, live in rural areas, or operate small businesses,” the American Medical Association said in the Sept. 15, 2025 letter, which the Texas Medical Association and dozens of state and national medical societies signed onto, citing a Centers for Medicare & Medicaid Services report.

“Even individuals who are not eligible for [advanced premium tax credits] will be affected by the expiration of the enhanced APTCs, as the enhanced APTC drew healthier people into the insurance marketplaces, improving the risk pool and lowering premiums overall,” the letter added.

Dr. Oquendo – who estimates 90% of his patients are on ACA health plans, many of whom already have trouble navigating the health care system – fears the expiring tax credits might add additional confusion, higher costs, and even a loss of insurance for those patients.

Consistent with other studies, AMA expects millions more will face significant increases in annual premiums.

Texas’ statistics are further complicated by the fact that the state did not opt for Medicaid expansion, which allowed those below 133% of the federal poverty level to sign up for Medicaid coverage. ACA health plans have provided a coverage option made more affordable by the tax credits, TMA analysts note.

Yet, an estimated 1.3 million Texans could lose coverage due to the combined effects of changes to Medicaid and ACA marketplaces under OBBBA and the expiration of the eAPTCs, according to KFF research.

“With the enhanced tax credits, middle-income enrollees making above 400% of poverty currently have their out-of-pocket premium payments for a benchmark plan capped at 8.5% of their income. However, if the eAPTCs are not renewed, these enrollees will experience a ‘double whammy’ – losing their eligibility for marketplace premium tax credits and facing the annual increases in the cost of a marketplace plan,” a KFF analysis states.

“Physicians are definitely going to feel the effects of the confusion and the drop of coverage for a lot of patients, especially during the transition, when people are not understanding exactly how this transition affects them,” said Dr. Oquendo, who chairs TMA’s Council on Socioeconomics, which is tracking the ACA impacts along with its Committee on Medicaid, CHIP, and the Uninsured.

OBBBA also instituted additional ACA marketplace changes, like shortened enrollment periods and stricter verification requirements, the impacts of which TMA is also tracking.

“This is going to have ramifications further down the road for health care costs, because more people are going to be using the ER; there will be more hospitalizations because people will postpone their care and get sicker,” said Cynthia Peacock, MD, chair of TMA’s Committee on Medicaid, CHIP, and the Uninsured. “There will also be a sicker workforce.”

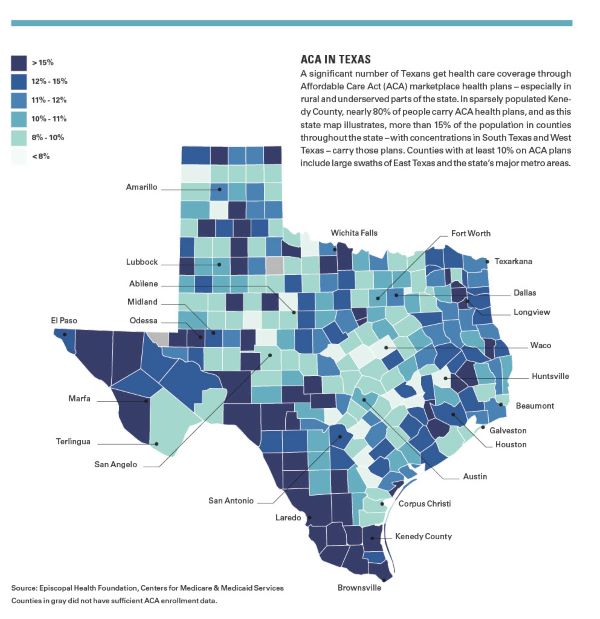

In Texas, a study by the Episcopal Health Foundation shows rural counties make up a significant portion of ACA enrollment.

“In county after county, ACA coverage is not a side option,” the study asserted. “It is a major part of the local health insurance landscape. And the subsidies that make those plans affordable are not just helpful. They are essential. In some places, subsidies reduce premiums by more than 90%. That kind of support is what makes coverage possible for thousands of Texans.”

In Starr County, for example, 26% of the population has an ACA plan, as do one in eight across a stretch of 20 East Texas counties.

“In many of those places, subsidies are doing a lot of heavy lifting to keep monthly premiums within reach,” the report noted.

Federally qualified health centers (FQHCs) are instrumental in Texas’ rural health, and lately, the availability of ACA marketplace plans (made more affordable by the eAPTC) have been key in helping individuals in rural areas who rely on FQHCs to get the health care they need.

“We were connecting people who were being disenrolled for Medicaid and getting them enrolled in the ACA marketplace,” said Jana Eubank, executive director of the Texas Association of Community Health Centers (TACHC), representing 79 FQHCs in the state – about half of those centers in rural Texas. These FQHCs operate around 700 sites serving an estimated 2 million patients.

She says in the last year, in large part due to the Medicaid unwinding in Texas, FQHCs in Texas saw a 26% jump in privately insured patients, and more than 80% of their centers’ patients with private insurance have ACA marketplace plans.

“The enhanced premium tax credits were absolutely a godsend in helping make private insurance affordable for many of our patients,” she said.

It’s also been important for the viability of many FQHCs, who receive federal grant funds and enhanced payment rates for services provided to Medicaid and Medicare patients, but are struggling to stay open nonetheless.

“Those dollars haven’t increased in 10 years, and we’ve doubled the number of patients we’ve seen in that same 10-year period,” Ms. Eubank said. “We’ve always had razor-thin margins because we can’t really control our payments.”

Citing a study TACHC did in spring 2025, with more than 60% of its member FQHCs responding, Ms. Eubank notes:

- 22% had to close a site over the last year;

- 27% have had to cut services;

- 50% have frozen salaries;

- 51% have had to lay off staff; and

- 58% have had to freeze hiring.

“If we take on an additional group of uninsured patients, whether they are existing patients that had been on marketplace [plans] but now become uninsured, or newly uninsured individuals who have been going someplace else with their marketplace coverage and come to the health centers, it just means we’re going to have an even worse payer mix,” she said.

As of this writing, even a potential short-term extension of the eAPTCs would create concerns about what happens if and when they do eventually expire.

“I’m anticipating a transition of people who are not going to come back because they’re going to either lose their coverage or they’re going to think twice about signing up when they were used to having no premium, and now they have to pay maybe even a couple hundred dollars of premium,” Dr. Oquendo said. “That might be a shock,” he added, predicting that an increase in uninsured patients might put more strain on emergency departments and urgent care centers.

In the final months of 2025, with the possibility of expiring tax credits looming, the Dallas pediatrician was making plans to keep care more affordable for his patients — starting with rolling out a direct patient care model.

“Patients who are part of our practice just pay a monthly fee, which allows them to receive more visits, lower-cost labs, lower-cost procedures and treatments, lower-cost testing,” he said. “So that way, they can maintain their ability to come to the office, even for a low price.”

Ramifications for insurance

TMA remains concerned about similar efforts in the 2027 session, warning an upheaval of ACA plans could lead insurers to forward more pro-payer bills under the guise of giving consumers more affordable options that in really shift a greater proportion of health care costs to patients.

During the 2025 session, a House bill promised a new type of “employer choice of benefits” health plan; TMA opposed that proposal because it failed to address the drivers of insurance premiums (e.g. administrative costs and risk pool status), included no guarantee the plans would be offered at a lower cost, and created a pathway for insurers to ignore all TMA-backed patient and physician protections won in past sessions. Protections at risk include coverage for things like newborn screenings and minimum coverage for patients with diabetes, consumer protections against deceptive marketing, and physician protections like prompt pay and network adequacy laws. Yet a retailored version of that bill in a climate where Texans are losing access to affordable ACA marketplace plans could be appealing to legislators.

TMA staff also cautions physician practices to be aware of nontraditional or alternative forms of insurance patients might utilize, as well as newly created plans from commercial insurers, should they lose their ACA health plans.

TMA will also monitor the impact the expiring eAPTCs might have on the current practice of silver loading that has helped sustain the eAPTCs. The four levels of ACA plans, from lowest to highest, are bronze, silver, gold, and platinum. Silver plans offer consumers an ACA-enabled provision called cost-sharing reductions (CSRs), which lower out-of-pocket costs for qualifying individuals at 100% to 250% of the FPL.

Since 2017, when federal support was halted for CSR payments, many states including Texas allowed insurers to raise silver plan premiums to make up for that loss. OBBBA reinstituted federal appropriations for CSRs, and while that could lower silver premiums, a KFF report noted it could also raise bronze and gold plan premiums and lead to more people – including middle-income people at two to four times the poverty level – losing insurance.

Dr. Peacock is concerned an increase in uninsured people – especially those who are young, healthy, and have prized ACA plans for their relative affordability – will adversely affect the risk pool, and in turn, insurance costs and practice viability.

“There’s going to be a lot of goodwill on the physicians’ parts to see their patients,” she said. “That’s not going to keep doors open, especially for independent practices.”

How the One Big Beautiful Bill Act (OBBBA) could transform Texas health care

A Mixed Medicaid Bag: Federal changes may narrow certain Medicaid eligibility provisions, boost others

Immigrant Eligibility Provisions: Federal officials approved these new immigrant eligibility provisions for Medicaid, Medicare, and the Affordable Care Act under OBBBA.

Community Support: Texas aims to use federal funding to address rural health care challenges

One Big Beautiful Bill Act changes: Key modifications introduced by the 2025 federal budget bill – known as OBBBA – that affect major health care programs.

Expanded Flexibility: Patients can now pay for direct primary care with health savings accounts – with caveats

Cap at Hand: Federal loan changes could exacerbate medical students’ financial challenges

How other federal budget items could affect Texas

Budget Crunch: Uncertainty besets Texas’ public health infrastructure as federal funding streams dry up

Concerns Remain: Medicare physician fee schedule retains payment increase and concerning cut

Amy Lynn Sorrel

Associate Vice President, Editorial Strategy & Programming

Division of Communications and Marketing

(512) 370-1384

Phil West

Associate Editor

(512) 370-1394

phil.west[at]texmed[dot]org

Phil West is a writer and editor whose publications include the Los Angeles Times, Seattle Times, Austin American-Statesman, and San Antonio Express-News. He earned a BA in journalism from the University of Washington and an MFA from the University of Texas at Austin’s James A. Michener Center for Writers. He lives in Austin with his wife, children, and a trio of free-spirited dogs.