Contract negotiator is one of many hats physicians wear throughout their career, whether accepting their first job out of residency training or selling their private practice in anticipation of retirement. But legal documents can prove daunting and seem fixed.

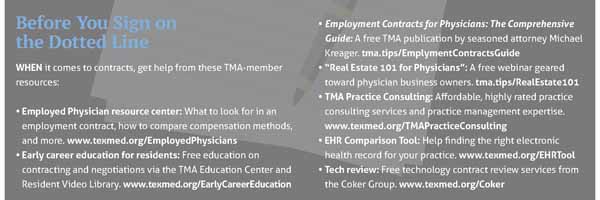

By leaning on Texas Medical Association resources and their own health care attorney, physicians can gain confidence and better negotiate favorable terms to secure their economic success. (See “Before You Sign on the Dotted Line,” page 29.)

Amanda Hill, an Austin-based attorney who has more than 20 years’ experience in health law, encourages physicians to approach contracts with the following three things in mind.

First, pick your battles. Physicians should consider their priorities when reviewing contracts and pick out a few things to discuss with the other party. She says this helps build goodwill and ensure a successful outcome.

Second, know the data. Whether negotiating your salary or a lease, it’s beneficial to research the local market and come armed with reasons to support your asking price.

Third, seek out help when needed. Health law is specific, and investing in an attorney who specializes in it can prevent costly mistakes.

Ray Callas, MD, an anesthesiologist in Beaumont and the newly elected chair of TMA’s Board of Trustees, echoes this advice, which he says can help physicians secure a victory at the negotiating table.

“Whenever you go into a battle … or contract negotiation, you want to make sure you have all the skills on your side,” he said.

Practice models

Recent statistics show a jump in employment arrangements, an area Austin health law attorney Amanda Hill is most often asked about by physicians.

According to the Physicians Advocacy Institute, by January 2021, about 70% of the nation’s physicians were employed by hospital systems and corporate entities like private equity firms and health insurers, representing double-digit growth in these types of acquisitions.

Ms. Hill recommends physicians negotiate the following provisions in employment contracts, as needed:

- Compensation and any bonus payments;

- A “back door” clause, which typically allows the employee 90 days to break the contract without incurring the full slate of consequences;

- Medical liability “tail” insurance, which, at great cost, may fall to the physician to cover upon leaving the job; and

- Noncompete clauses, which, post-employment, may prohibit a physician from practicing medicine within a geographic area for a specific period.

Rodney Young, MD, a family physician in Amarillo and immediate past chair of TMA’s Council on Socioeconomics, says noncompete agreements are a growing concern as physicians increasingly seek out employment at large groups and hospitals versus independent practice.

Although employed physicians typically find noncompete agreements prohibitive and potentially disruptive to patient care, physician employers use them to protect their investments in recruiting physicians, according to a recent informational report by the council. “I don’t think anyone disputes the reasonable need to protect or recover an investment like that,” Dr. Young said, adding that negotiation can help serve both parties’ interests.

For instance, physicians might negotiate to restrict a noncompete agreement to a specific geographic area or to ratchet down the penalties after a certain amount of time has elapsed.

In other practice models, physicians might encounter contract elements that include participation agreements, commercial leases, and force majeure clauses, for instance.

Kim Harmon, TMA’s associate vice president of innovative practice models, says physicians who are considering joining an accountable care organization (ACO) to participate in a value-based care payment arrangement should make sure they have an exit strategy. This can help prevent the loss of any incentive payments the ACO makes to its participating physicians.

Teri Deabler, a TMA practice management consultant, encourages physicians to seek outside help in areas they are unfamiliar with, such as a consultant and a real estate broker with health care experience, when negotiating office space or lease renewals.

“We [consultants] know the questions to ask,” she said. “Even if we’re hearing it for the 10th time, the physician’s hearing it for the first time.”

And for protection from events or circumstances out of physicians’ control, so-called force majeure clauses may exempt physicians from certain contract obligations, and may be more common in light of the COVID-19 pandemic. Such clauses typically appear in commercial and employment contracts.

Given the significant impact the pandemic has had on businesses, besides the typical acts of nature, or God, or disaster-type language included in force majeure clauses, Ms. Hill recommends physicians make sure they include the word “pandemic” or even more specific language, such as “COVID-19 shutdowns,” as a safety mechanism.

Technology vendors

Texas practices may find themselves upgrading electronic health record (EHR) systems for the first time in a decade marked by rapid technological advancements.

Larry Chu, MD, an otolaryngologist in Austin and a member of TMA’s Committee on Health Information Technology, advises physicians to take as much care with the EHR vendor contract as they do with EHR vendor selection.

“Even though much time has been invested in selecting the technology product, do not neglect the contract terms,” Dr. Chu said. “The devil is in the contract details, and it’s important to understand what you are agreeing to before you sign on the dotted line.”

Shannon Vogel, TMA’s associate vice president of health information technology, says a few contract modifications can help physicians avoid much of the risk associated with buying technology, which is an integral part of modern health care.

Here are 10 factors to consider:

- Version protection: Many vendors discontinue software – only to resell you the newer version. Instead, the vendor should provide future releases, system updates, and new versions at no additional cost. You likely will pay annual licensing fees that should cover software upgrades.

- Government mandates: The vendor should stay in compliance with all government mandates and modify its software accordingly at no cost. This includes EHR certification requirements.

- Tech support: Stipulate in the contract that support fees cannot increase by more than the consumer price index.

- Contract validity: Ensure the contract is not valid until the vendor meets your acceptance requirements – such as the system operating as promised.

- Warranty: Ensure the vendor will correct any malfunctions at its expense and will waive support fees throughout the correction period.

- Malfunctions: Insist that malfunctions not corrected within an agreed-upon time result in a full refund.

- Source code: The vendor should put the source code – the programming language that makes the program work – into an escrow account. Additionally, EHR vendors cannot block or terminate your access to your patients’ information.

- Transferability: The vendor should allow you to add future users at a reduced cost and to assign or transfer your contract to a new owner.

- Additional users: Ensure you can add future users at a reduced cost.

- Protection: Cybersecurity protection for the product should be at the vendor’s expense.

Health plans

Independent physicians know firsthand how important health plan contract negotiations are to their business’ bottom line, even though the conversations often are stressful and seem skewed in the health plan’s favor.

Ray Callas, MD, chair of TMA’s Board of Trustees, says aggressive negotiation tactics and recent legislative and judicial victories can help level the playing field.

During negotiations, the Beaumont anesthesiologist tries to build a relationship with the health plan’s representative but without hesitation seeks out his or her superior when necessary. Although going above the representative’s head may feel risky, he says it can help secure more favorable terms that require a higher-up’s approval.

Heather Bettridge, TMA’s associate vice president of practice management consulting, also encourages practices to:

- Consider the health plan’s contract, fee schedule, and administrative requirements to ensure the insurer is a worthy partner;

- Research similar practices to determine what sets their own practice apart; and

- Prepare to negotiate the fee schedule as well other contract elements, such as indemnification, arbitration, and evergreen clauses; burdensome timeframes; and restrictive credentialing and licensure requirements.

Knowing TMA has physicians’ backs when going toe-to-toe with health plans also should bolster doctors’ confidence at the negotiating table, Dr. Callas says. For instance, TMA recently won state relief from unwieldy prior authorizations and federal relief from a rule that would have favored health plans in surprise-billing disputes.

Dr. Callas says although health plan negotiations still sometimes feel like a futile undertaking, these kinds of policy shifts have changed his attitude for the better.

Emma Freer

Associate Editor

(512) 370-1383