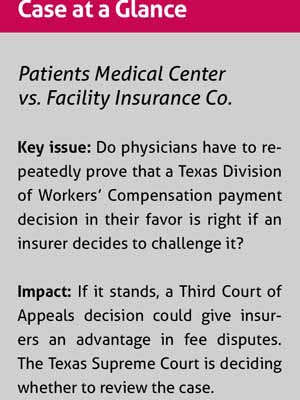

Medicine is working to upend a recent appeals court decision that threatens to give health plans an overwhelming advantage in fee disputes in workers compensation cases.

When doctors think they were underpaid for treating an injured worker, they can take their complaint to the Texas Division of Workers’ Compensation (DWC) for review. The fee-dispute process that starts there – and can continue with appeals – works as intended, says Adam Bruggeman, MD, president of the Texas Orthopaedic Association.

First, DWC asks for supporting documentation from the physician and the insurer and makes a final decision on the payment based on its rules. If the physician or the health plan is unsatisfied with that decision, either can appeal to an administrative law judge and then to state court. Whoever appeals has the initial burden of proving its case.

“We have not had a lot of issues in the current system,” said Dr. Bruggeman, who treats a fair number of workers’ compensation patients in his San Antonio practice, Texas Spine Care. “Things have gone well. The appeals system has worked, and both sides have thought it was fair.”

But a December 2018 Third Court of Appeals ruling would force physicians or hospitals who already showed the DWC that they were underpaid to prove it again if the insurer appeals – even though DWC already found in their favor. And then, if another appeal comes, the doctor or hospital would have the burden of proof again. Another appeal? Same thing. It becomes a cycle.

To help prevent that tilt in health plans’ favor, the Texas Medical Association weighed in with a friend-of-the-court brief in November as the Texas Supreme Court considers whether to review the case.

If the appeals court’s decision is allowed to stand, even if DWC agrees with a physician in a fee dispute, the doctor “will bear the cost and initial burden of the insurance company’s appeal at each and every stage of appeal all the way to [the state Supreme Court],” TMA’s brief stated. “This may deter providers from seeking fair reimbursement through DWC’s process and encourage insurance companies to continually [underpay] providers for their services. Ultimately, the workers’ compensation system itself, and Texas’s patients in the system, may suffer because providers may choose not to participate.”

DWC – the very agency whose rules are at the center of the dispute – also weighed in on the case with a friend-of-the-court brief in support of the current system.

“There’s no downside” for insurers in appealing payment decisions that don’t go their way, said Dan Holloway. He is an attorney for Patients Medical Center in Pasadena, the hospital seeking additional payment in the case, which has ramifications for other health care entities and practitioners as well.

Even for Texas hospitals going up against insurers, “workers’ compensation appeals are like holding onto the ledge with your fingers, and they just stomp on your fingers with steel-toed work boots until you fall off,” he said. “If it gets to the point where it’s not even feasible for hospitals to pursue their claims, then you can bet doctors are going to stop.”

DWC: Hospital underpaid

In September 2009, an injured worker covered by workers’ compensation insurance had outpatient surgery at Patients Medical Center, according to court documents. The hospital’s court filings say when it submitted its claim for payment, Facility Insurance Co. denied payment for “most of the items and services provided, and claimed it had applied discounts based on an ‘informal network’” it had with one particular insurer. It paid Patients Medical $2,354.75, well below what the hospital had billed.

Patients Medical filed a fee dispute resolution request with DWC, claiming no informal network contract applied to the payment.

In a March 2013 decision, DWC agreed with the hospital and awarded Patients Medical more than $20,000 in additional payment.

An attorney for Facility Insurance Co. did not respond to Texas Medicine’s request for comment.

After DWC found in the hospital’s favor, Facility Insurance appealed the decision to the State Office of Administrative Hearings (SOAH), which upheld DWC’s finding and ordered Facility to pay the additional money. But the insurer wasn’t done fighting, taking its case to Travis County District Court. Once again, the hospital won.

A big reversal

Then the insurer appealed the case to the Third Court of Appeals, which saw the case differently.

In a December 2018 decision, justices said the hospital – not the insurer – had to prove its case at SOAH.

“In this … context, the salient dispute remains a constant throughout the [medical fee dispute resolution] process, including the hearing at SOAH: to how much reimbursement is the provider entitled?” Justice David Puryear wrote. He added that by initiating the dispute resolution at the beginning, “the provider is seeking to change the status quo – the status quo being that the carrier has refused to pay a reimbursement claim. … Yet, the [administrative law judge] explicitly placed the burden of proof” on the insurer.

The appeals court ordered the case to go back to DWC. That prompted Patients Medical to ask the Texas Supreme Court to review the case.

A DWC rule says that in a SOAH case, the “party seeking relief” has the burden of proof. A preamble with the adopted rule, Patients Medical had argued in court filings, makes it even clearer: That language applies to someone who “seeks to change the result of an initial medical dispute decision” the DWC makes.

In its Supreme Court petition, the hospital argues that DWC rules “unambiguously state how and under what circumstances the burden of proof is to be assigned” if a DWC decision is appealed to SOAH. If allowed to stay in place, the Third Court of Appeals’ interpretation void DWC’s own rules.

On the other hand, Facility Insurance’s filings claim the DWC rule “places the initial burden on the ‘Requestor’ (here, the Hospital), which is asking for additional money.” It says the administrative law judge “presumptively adopted” the calculations of the DWC’s medical dispute resolution officer “and all the legal and regulatory errors that went with them. … There is no evidence in the record to support the $20,495.78 additional payment figure adopted by the [administrative law judge].”

The state’s largest workers’ compensation insurance carrier, Texas Mutual Insurance Co., agrees with the appeals court’s decision.

Mary Nichols, Texas Mutual’s senior vice president and general counsel, said in a statement to Texas Medicine that the appeals court “applied the clear and well-understood administrative law principle that the person seeking relief bears the burden of proof. It also accurately and sensibly identified the health care provider who is asking for money as the ‘person seeking relief.’ It also pointed out that if an insurance carrier were seeking the money, for example as a refund, it would, under the same logic and judicial principles, be the ‘person seeking relief’ and would thus bear the burden of proof throughout the process.”

Deterrent to fairness

TMA, however, argues in its friend-of-the-court brief that the court of appeals decision “creates bad public policy by giving insurance companies significantly more power in DWC’s medical reimbursement dispute process.” It says the division sets the guidelines for payment “and provides a non-costly method” of dispute resolution. And if one of the sides disagrees with the DWC, it can continue the dispute to SOAH “and carry the burden of proof and related costs to defend its position.

“The Court of Appeals’ decision changes this dynamic for provider-initiated medical reimbursement disputes by placing the burden on appeal on the provider even if the provider agrees with DWC’s findings,” TMA emphasized.

DWC’s friend-of-the-court brief in support of Patients Medical said the “new, unworkable static burden” the appeals court created “threatens the system’s integrity.” The inequity the appeals court decision creates “will aggravate providers’ routine cost-benefit analyses when considering whether to initiate the Medical Fee Dispute Resolution process in response to carriers’ action on medical bills,” DWC wrote.

Dr. Bruggeman is concerned if the ruling is not overturned, insurers could make it “really difficult for patients to get the care they need” and difficult for physicians to get paid. “I think this could really, dramatically change the way that [physicians] do business,” when it comes to workers’ compensation cases, he said.

At press time the Supreme Court was still deciding whether to accept the case.

Tex Med. 2020;116(1):32-36

January2020 Texas Medicine Contents

Texas Medicine Main Page