As a physician, you know it’s essential to communicate with a patient to fully understand the health issues they face and how to treat them.

In the same manner, it’s important to have open and ongoing communication with your facility administrators to maintain an accurate compensation plan. To ensure you are paid for the work you do, it’s essential to be actively involved in reviewing work Relative Value Units (wRVU) calculations.

To help you navigate wRVU reviews and calculations, Mollie Mailman, a Texas Medical Association practice management consultant, has suggestions for common questions you should be asking your facility or practice administrator.

How are physician wRVU’s calculated?

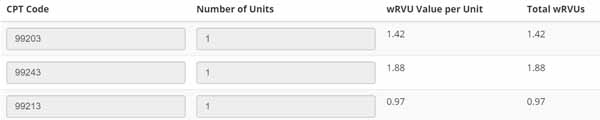

Physician wRVUs account for the time, technical skill and effort, mental effort and judgment, and stress to provide a service. Ask your administrator how wRVU’s are calculated in your facility as they are not universal values. Ask your administrator to provide you with a breakdown of wRVU value per CPT code bill. This way when your production is reported monthly you can verify your numbers.

Example:

How often should financials and production be reported?

The best practice is to report your production and metrics monthly. Depending on your facility’s structure, salaries will be “trued up” biannually or quarterly.

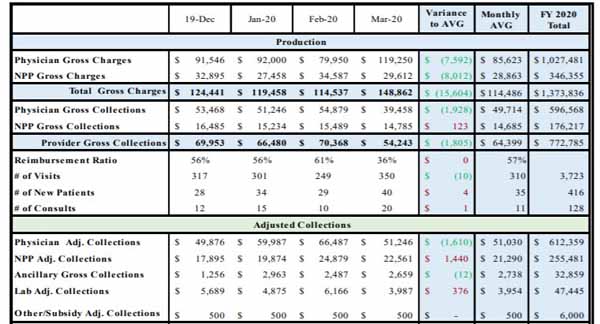

What should be in the report?

Basic information in your monthly reports should be gross charges, gross collections, number of patient visits, number of new patients, number of consults, and total number of wRVU’s for the month. Ask your administrator to date your report, to make sure the month has closed and the report captures all the data correctly. Sometimes patient encounters will fall into the preceding month.

Image from Practice Viability Toolkit

Where should I set my salary draw?

A salary draw is a percentage of your estimated salary for the year. It is a set amount that you will receive every pay cycle. If you set your draw low, for example at 50% of your estimated salary, you will have larger salary true-ups. If you set your draw high, for example at 90%, you will have relatively small salary true-ups. Where to set your draw is a personal question and depends on your comfort level. Take factors such as vacation and maternity leave into consideration. Note, if you set your draw high at 90% and have lower production that year, you will owe money back to your employer. Best practice is to set your draw around 70-80% of your estimated annual salary.

How are practice expense RVU’s calculated?

Practice expense RVUs account for the nonphysician clinical and nonclinical labor of the practice, as well as expenses for building space, equipment, and office supplies.

Large hospital systems often have backend calculations to account for these expenses. It’s important to know what percentage of every $100 you bring into the practice is being deducted from an expense. Knowing whether $40 or $60 of that $100 is being deducted can let you know if you are being “charged” fairly for expenses or not. In other words: Physician wRVU – Practice Expense RVU = Net Income to Physician

How do I know if I have hit my Incentive Compensation Clause?

Some physician contracts have production thresholds built in. If you have a higher production than expected, employers will provide increased compensation. These are referred to as Increased Compensation Incentive (ICI) clauses, pronounced “icky”. Read your contract closely to see how the threshold is measured and within what time frame it qualifies. Most often, they are defined in the form of wRVU and paid a certain dollar amount over the threshold as a multiplier.

To help you make informed financial decisions, use these resources that are available to TMA members.

Ms. Mailman has 10 years’ experience in health care, working within hospitals and specialty-based outpatient practices. Her expertise includes financial reporting and analysis, budget forecasting, operational efficiencies, and strategic planning.