As a large-practice physician, San Antonio orthopedic surgeon Sergio Viroslav, MD, is fortunate to have a team of practice managers to sift through regulations stemming from the No Surprises Act (NSA).

But that doesn’t make them any less confusing.

“Even though the rules seem to be coming from a positive place, I’m incredibly nervous that if I don’t understand those rules 100%, my practice will be penalized,” he said.

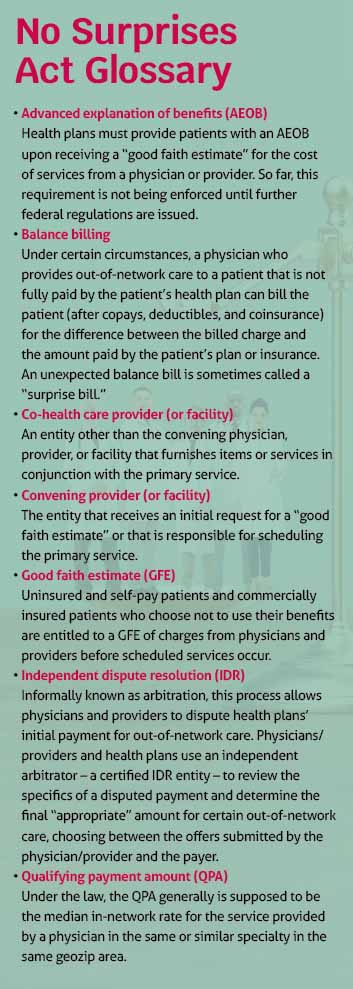

This is especially true when deciphering the requirement to provide a good faith estimate (GFE) of charges to patients who choose not to use their health insurance or are uninsured or self-paying. (See “No Surprises Act Glossary,” page 14.)

Dr. Viroslav understands the requirement was designed to protect patients from unexpected medical expenses and provide clarity, and federal officials have issued guidance and templates. Still, he worries about the complexity and burden for physicians who must now “double as practice managers,” especially as estimates may involve services provided by other physicians.

He’s also concerned about the time it takes away from patient care. “These time constraints have the potential to delay procedures because physicians are forced to spend more time working on estimates than scheduling procedures,” he said.

“This puts the burden on the practice and on the physician to make sure that every entity that touches that patient is compliant with the rule,” Dr. Viroslav cautioned. “Being aware of these requirements and the good faith estimate timeline is the best course of action.”

Who’s responsible for what?

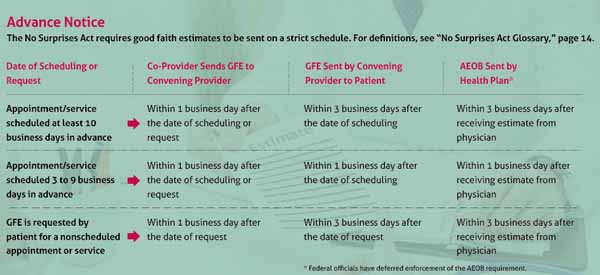

That timeline can be strict. (See “Advance Notice,” below.)

The requirement for a good faith estimate applies to patients who:

- Do not have health insurance of any kind; or

- Do have health insurance that would pay for all or part of their treatment but decline to use it.

“Generally, all providers and facilities that schedule items or services for an uninsured (or self-pay) individual or receive a request for a GFE from an uninsured (or self-pay) individual must provide such individual with a GFE,” the U.S. Department of Health and Human Services (HHS) said in a 2021 fact sheet. “No specific specialties, facility types or sites of service are exempt from this requirement.”

And all physician practices must inform uninsured and self-pay patients of the ability to receive a good faith estimate upon scheduling or upon request and clearly display such a notice in the office and on the practice’s website.

A good faith estimate could apply to services ranging from a simple doctor’s visit or medical test provided in a primary care setting to a more complicated procedure that involves multiple specialists, according to the Centers for Medicare & Medicaid Services (CMS). The agency provides a sample standard template physicians can model their estimates after.

A practice’s responsibility to provide a good faith estimate will differ based on whether it’s considered a convening physician or a co-provider.

For example, if a patient schedules surgery and specifies they are uninsured or self-paying, Dr. Viroslav’s practice, the San Antonio Orthopaedic Group, may be responsible for scheduling the primary service, in this case, surgery, and would thus be the convening provider, says Amber Vasquez, the practice’s director of revenue cycle.

The convening physician is responsible for:

- Determining which individuals are uninsured or self-pay patients;

- Providing notice of the availability of a good faith estimate;

- Contacting anticipated co-providers to collect good faith estimate information from them; and

- Preparing and providing the good faith estimate.

Co-providers must respond to the convening provider’s request for estimate information for inclusion in the good faith estimate.

Insured patients can ask for an estimate too, and their health plans also have a responsibility to provide an advanced explanation of benefits (AEOB) for services scheduled at least three business days in advance of the service, or at the member’s request if the service has not yet been scheduled, regardless of whether the services are in or out of network.

The process adds to confusion and administrative burden for practices, says Ms. Vasquez.

“For our practice, a good faith estimate would include physician professional fees, assistant surgeon professional fees, facility fees, any prescription drugs and durable medical equipment fees, among other fees stemming from services that would happen following the service,” she said. “As you can imagine, compiling all of that information is incredibly time consuming.”

Recognizing these administrative burdens, coupled with ongoing efforts to establish standards for AEOB data transfer between physicians and facilities and health plans, federal officials have deferred enforcement of the AEOB requirement.

But Dr. Viroslav says federal officials’ communications on who is responsible for what fell short.

“The language of whatever communication we have received is not straight to the point. My team had to research different avenues of information just to understand good faith requirements,” he said.

Moreover, an AEOB can only be issued to patients after the physician submits a good faith estimate to the insurer, placing physicians on deadlines across multiple parties, says Ms. Vasquez.

“It’s an inherently aggressive timeline and a hard requirement to fill with the payers. And because all payers are different, there may be different submissions and the turnaround times we must be aware of. We try our best,” she said.

Dr. Viroslav adds that the process asks practices to create a line of communication with payers that otherwise doesn’t exist and puts compliance ahead of patient care.

Potential penalties

Patients do have recourse, and other penalties could be steep.

Patients may contact the practice to let it know the billed charges are higher than the good faith estimate. They may ask physicians to update the bill to match the estimate, negotiate the bill, or ask if financial assistance is available.

Or, if an uninsured or self-pay patient is billed for an amount that exceeds a good faith estimate by $400 or more of the total expected and total billed charges, the patient can access the patient-provider dispute resolution process for a small administrative fee. (This is separate from the independent dispute resolution process between physicians and payers. See “Seeking Balance,” page 12.)

Disputed claims are handled by a certified third-party entity to determine the final payment amount, which can be the estimated amount, the final bill, or some other amount between these two amounts, says CMS.

Dr. Viroslav worries this will “drive distrust between patients and their doctors.”

“It’s just another erosion of the doctor-patient relationship,” he said. “An estimate that was incorrect was caused, nine times out of 10, by clerical error or simple oversight. That isn’t malfeasance.”

According to CMS, insurers can be charged up to $100 per day for each patient affected by a violation, and practices can face a maximum civil monetary penalty of $10,000 for each violation of the NSA.

To avoid causing more work and worry for practices, and to simplify workflows, Ms. Vasquez recommends a good faith estimate be provided to all patients, insured or otherwise.

She also reminds physicians that good faith estimates must be provided in written form. That can be either on paper, via email, or electronically through the convening physician’s patient portal, as long as they are written using clear and understandable language and patients can both save and print those estimates.

The good faith estimate also should be provided verbally and followed up in writing, per CMS. A verbal response alone will not be considered compliant. A good faith estimate is considered part of the patient’s medical record and must be maintained in the same manner as a patient’s medical record. Convening providers and convening facilities must provide a copy of any previously issued good faith estimate furnished within the last six years to an uninsured or self-paying individual upon request.

“I would also recommend that practices look into software that can help push out these estimates,” Ms. Vazquez said. “Especially with such harsh electronic requirements.”

Dr. Viroslav also recommends spending more time with patients to discuss medical costs.

“Like in any business, communication is key. Let the patient know what to expect of their procedure cost. … [W]e need to be more thoughtful about the process,” he said. “It’s a lot to understand. But it can be done.”