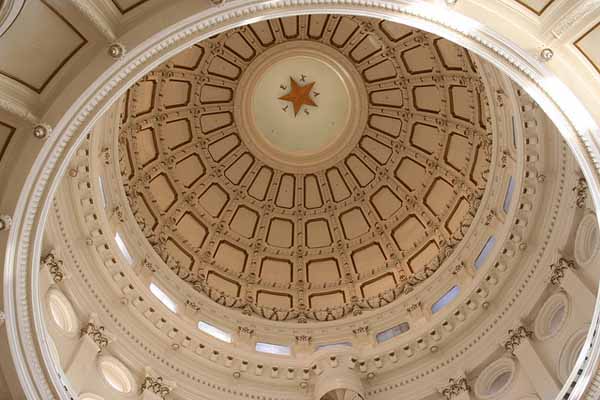

UNDER THE ROTUNDA

A tax on medical billing companies means a tax on physician practices. The house of medicine knows that’s the last thing you need, especially right now.

So, the Texas Medical Association went to work today in hopes of torpedoing a state medical billing tax currently scheduled to take effect Oct. 1.

In late 2019, the office of the comptroller was getting industry pressure that medical billing services counted as insurance services because the billing companies’ preparation of a claim “constitute[s] claims adjustment or claims processing.” That interpretation makes medical billing services taxable. The comptroller's office has graciously worked with TMA and other stakeholders to provide guidance on legislation that would prevent this from going into effect.

The House Ways & Means Committee today looked at that fix,

House Bill 1445 by Rep. Tom Oliverson, MD (R-Cypress). Tyler obstetrician-gynecologist Yasser Zeid, MD, represented TMA at the Ways & Means hearing.

If HB 1445 becomes law, it would protect billing companies – and by extension, their physician clients – from a tax of up to 8.25% (the state’s standing 6.25% tax on insurance services, plus a potential 2% more from local taxes).

“Many small … practices rely on third-party billing services, as they do not have the resources to provide billing preparation and submission in house,” Dr. Zeid told the committee. “HB 1445 will ensure that physicians and other health care providers are not taxed for the initial submission of health care claims. Additionally, this legislation will also prevent potential increase in cost to patients as well.”

HB 1445 would specifically state in the law that medical billing isn’t insurance. Its companion measure is Senate Bill 775 by Rep. Robert Nichols (R-Jacksonville).

Gun Safety

Austin psychiatrist Thomas Kim, MD, testified today on House Bill 909 by Barbara Gervin-Hawkins (D-San Antonio), which would designate June as Firearm Safety Awareness Month. He testified on behalf of TMA and the Texas Pediatric Society (TPS).

In written remarks to the House Culture, Recreation, and Tourism Committee, Dr. Kim noted that the most recent available data show Texas had the most firearm-related deaths in the nation in 2016 at 3,353. And in 2015, 609 Texas children were killed or injured by a firearm.

“TMA and TPS members remain focused on proven prevention and harm reduction methods in all areas of public health,” Dr. Kim wrote. “Physicians have a role in addressing gun violence and firearms safety. We are talking to our patients about safety measures in the home, including the measures that will prevent firearm mortality and morbidity.”

TMA Needs Your Expert Help

The 2021 legislative session is already nearing the halfway point, and the opportunities to stop bad bills and promote good ones are mounting. Time-sensitive Action Alerts are an effective and an efficient way for you to share your messages of concern and support with legislators from the convenience of your desk or mobile phone.

Action Alerts arrive by email and have a pre-written response, to which we strongly encourage you to add a personalized story or anecdote about how the proposed legislation will affect you, your patients, and your practice. You can access Action Alerts from the email you receive, our Grassroots Action Center, or the VoterVoice mobile app. Just click the link and go. Easy Ways to Get Involved in TMA Advocacy

Your participation is a vital component of our legislative success. Join our advocacy efforts today.

Stay up to date on bills TMA is following closely. And take advantage of other opportunities to get involved with our advocacy efforts.