Let Me In, Let Me In

Beaumont anesthesiologist Ray Callas, MD, is tired of beating his head against the wall trying to get “in-network” with health insurance companies. And he’s tired of the surprise bills his patients receive when he can’t get in.

Beaumont anesthesiologist Ray Callas, MD, is tired of beating his head against the wall trying to get “in-network” with health insurance companies. And he’s tired of the surprise bills his patients receive when he can’t get in.

“If I’m out-of-network, but I’ve tried time and again to negotiate with networks and still can’t get in, I believe insurance should accept some of the responsibility for that bill,” he said.

And Dr. Callas is not an outlier.

TMA’s biennial physician survey shows 67 percent of physicians with no contracts who attempted to join a network received either no response or a “take it or leave it” offer. Thus, when physicians are not part of a network, it is generally because they either have no choice or no bargaining power.

And neither do their patients. Surveys show that as many as 60 percent of Americans have received a surprise bill from an out-of-network physician or provider. Many of them result from emergency medical care.

Especially in emergencies, it’s common for someone like Dr. Callas not to know if he’s in-network for the patient in front of him.

“My responsibility as a patient’s physician is to know the risks of administering anesthesia, not administering their personal insurance plan,” Dr. Callas said. “Frankly, educating patients regarding their insurance plan and what is and is not covered, and how to meet deductibles — that’s the responsibility of the plan. Don’t just hand them a 75-page booklet and tell them their benefits are described within.”

Narrow, inadequate networks can mean little or no access to critical services. The plans themselves determine how their networks are established and what physicians and providers will participate in those networks.

Physicians have a real and powerful incentive to be part of the insurance companies’ networks: Most believe they must contract with at least one commercial payer to have a financially viable practice.

Health plans, on the other hand, profit from skimpier networks.

“Insurance companies with narrow networks shame physicians into looking like the bad guy for billing for services rendered but unpaid, when the truth is I’ve tried to get in-network but have been offered less than desirable or even fair terms,” Dr. Callas said. “What other profession is expected to provide services regardless of the terms?”

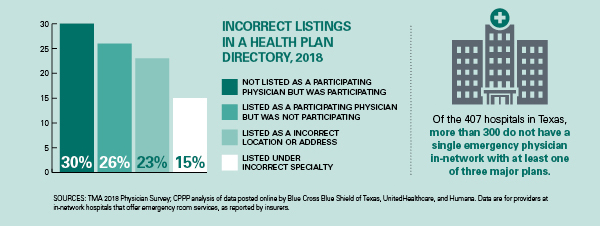

Health insurance is supposed to protect you in case something goes terribly wrong, saving you from potential financial disaster. But the company selling it makes more money if you don’t, or can’t, use it. Insurance companies accomplish that by limiting the number of in-network physicians, hospitals, and providers; by publishing inaccurate network directories; by confusing patients about their coverage; and by constantly changing their rules and procedures. All of that makes patients pick up more of the tab they thought they had purchased insurance to cover.

Make Networks Work for Patients

Using narrow networks, or very limited lists of in-network physicians patients can see, is one scheme insurers use to maximize their profits; it transfers much of their financial liability to patients in the form of surprise bills. The health plans’ notoriously inaccurate network directories add to patients’ confusion. Texas’ successful mediation program for balances of $500 or more in certain out-of-network situations is helping to protect patients, but the state needs to do more to enforce strong network standards.

TMA recommends that the Texas Legislature:

- Protect physicians’ rights to set their charge and collect outstanding balances.

- Support the continued use of mediation for patients to resolve surprise bills.

- Require health plans to create and maintain adequate networks. Expressly authorize and require TDI to perform network examinations of preferred provider benefit plans on a routine basis. Augment the authority of the Office of Public Insurance Counsel (OPIC) to monitor network adequacy.

- Require health plans to provide accurate information on physicians’ network status, updated in real time.

Undo the Confusion

Insurance companies frequently use jargon and complex small print to lay out what coverage patients have, or to announce changes in the terms of their plans. That makes it nearly impossible for patients to figure out what they have to pay.

TMA recommends that the Texas Legislature:

- Require health insurance companies and their agents to explain in plain language exactly what a patient’s health plan will and won’t cover, as well as the patients’ financial responsibility before they purchase a policy.

- Prohibit insurance plans and pharmacy benefit managers (PBMs) from switching patients’ prescription drugs for non-medical reasons.

- Prohibit plans from terminating physician contracts without cause.